A clear path to profitability

FY23 Financial Results Announcement

Black Pearl Group Limited (“BPG” or “Company”) is pleased to announce its unaudited preliminary results for the year ended 31 March 2023 (“FY23”).

The 2023 financial year was underpinned by purposeful investments in acquisition, technology, and a public listing, all paving the way for the Company’s accelerated path to profitability.

Unaudited Financial Results Summary

The FY23 financial statements of BPG are still in the process of being audited, however BPG is not aware of any likely qualifications. The Company is not proposing to pay any dividends for the year ended 31 March 2023.

Key financial highlights:

- Total Subscription Revenue increased by 97%

- Gross Profit Increased by 264%

- Total Operating Costs $7.9m

- 85% increase in Net Assets

- 496% increase in customer base

The unaudited result was in line with the Board’s expectations for the year-end and sees BPG continue to deliver on its drive to profitability in FY24.

Karen Cargill – Chief Financial Officer, Black Pearl Group Limited, commented – “For technology companies, ‘profit is the new growth’. Over the FY23 financial year, there was a seismic shift in how technology companies were valued – with a premium being placed on profitability. BPG worked hard over FY23 to not only get ahead of this trend but to ideally position itself to capitalize on it.

Given the stability of the Company’s servicing costs, the availability of affordable and flexible resources, and the rapid growth of BPG’s data services the Board expresses strong confidence in BPG’s favourable positioning to achieve substantial results in FY24 and beyond.”

Outlook – a clear path to profitability:

BPG’s Listing Document outlined the Company’s strategic initiatives that are driving its path to profitability. A key component of this strategy involved the continual augmentation of data streams within the Pearl Engine, enabling the development of novel services. These services serve as catalysts for acquiring new customers while also providing avenues for cross-selling to the existing customer base.

By adopting this approach, BPG was able to swiftly deploy Pearl Diver to the market.

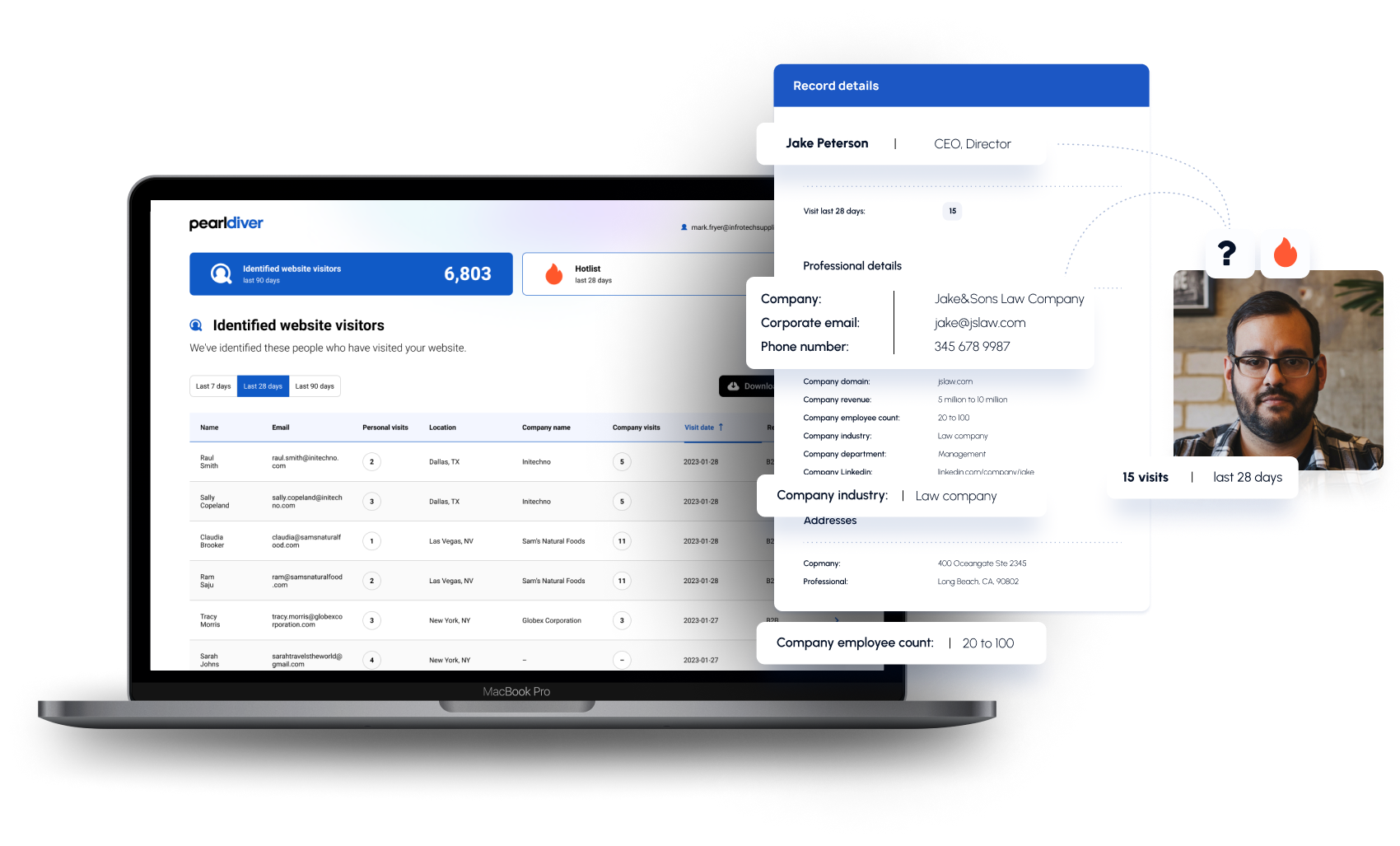

Pearl Diver

Pearl Diver is a SaaS product that shows businesses the individuals that are visiting their website, including the visitor’s name, contact numbers, email addresses, physical addresses, job information, and more.

Key contributors to the success of Pearl Diver include:

- The ability to sell directly to the existing customer base (3,800) across all Services.

- The ability to upsell directly to inbound traffic on the NOS (1m+ annually) and BPM (140k+ annually) websites.

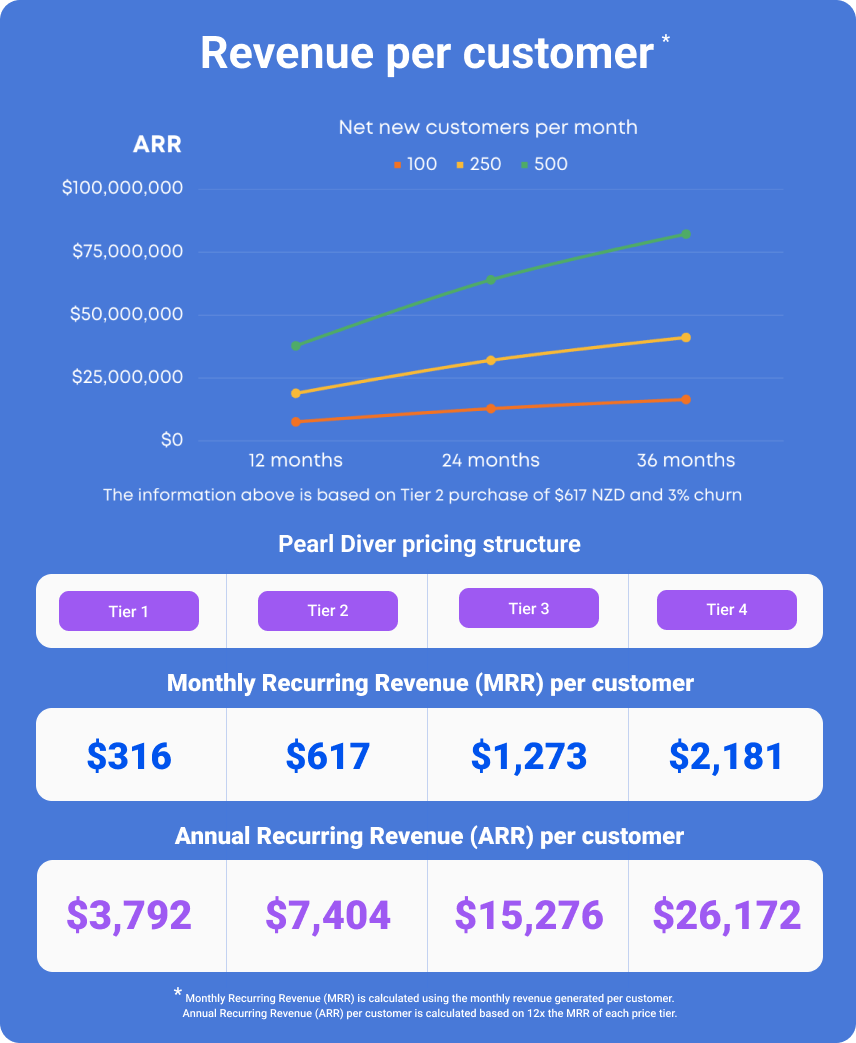

- Higher Annual Recurring Revenue (ARR) per customer than existing products (minimum of approx. 10x greater than the NOS service)

- Access to new markets and distribution through partner networks.

Diagram 1: Shows compounding nature of Pearl Diver revenue and resulting ARR based on various potential customer acquisition rates.

Throughout March, Pearl Diver was released to the US market in a staged approach, during which the BPG secured over 50 orders from both existing and new customers.

In May, new sales have generated $282,942.00 in net new ARR (in addition to already recurring ARR), with an immediate provisioning queue of new customers worth $56,331.00 ARR.

Chief Financial Officer Comment:

“For technology companies, ‘profit is the new growth’. Over the FY23 financial year, there was a seismic shift in how technology companies were valued – with a premium being placed on profitability. BPG worked hard over FY23 to not only get ahead of this trend but to ideally position itself to capitalize on it.

Given the stability of the Company’s servicing costs, the availability of affordable and flexible resources, and the rapid growth of BPG’s data services the Board expresses strong confidence in BPG’s favourable positioning to achieve substantial results in FY24 and beyond.” – Karen Cargill – Chief Financial Officer, Blackpearl Group.

Please refer to BPG – FY23 Financial Statements and BPG – FY23 Financial Commentary for the detailed results:

https://www.nzx.com/announcements/412290

For and on behalf of the Board,

Karen Cargill

Chief Financial Officer

For further information, please contact:

karen.cargill@blackpearlmail.com | +64 21 135 5183